fulton county illinois property tax due dates 2021

The Fulton County Auditors Office has switched to a new property search website. Property tax bills mailed.

Documents Chateau Hotel And Conference Center Sold For 2 7 Million Local Business Pantagraph Com

Fulton County property tax bills and payments.

. The second installment due date is Friday Sept. Cook County and some other counties use this. Pay Your Fulton County Treasurer IL Tax Bill Online.

Sub-tax payments will be accepted starting mid-September. Cook County Property Tax Portal. The first installment due date is Friday June 3 2022.

The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Last years equalization factor for the county was 10000. Assessments in Fulton County are at 3333 percent of market value based on sales of properties in 2018 2019 and 2020.

Make check payable to. Federal Quarterly Estimated Tax 4th. Taxes paid after 10 days are subject to a 10 penalty.

City of Atlanta residents - October 31. 173 of home value. C Corp Form 1120 Tax Return final due date if extension was filed.

Fulton County GIS maps. 042922 Property Tax bills are mailed. 050222 Drop Box window opened.

The median property tax in Fulton County Illinois is 1406 per year for a home worth the median value of 79000. Fulton County Property Taxes due. We have received the rates from the state and the property taxes have been calculated 2021P2022.

The Cook County Treasurers Office website was designed to meet the Illinois Information Technology Accessibility Act and the Americans with Disabilities Act. If you have questions do not hesitate to. Ad Look Up Any Address in Illinois for a Records Report.

Illinois is ranked 893rd of the 3143 counties in the United States in order of the median amount of property taxes collected. Claim your RD Tax Credits on Q3 Form 941. City of Gloversville County Property Tax beginning January 1.

3 penalty interest added per State Statute. 062022 JUNETEENTH - OFFICE CLOSED. 2022 DEVNET Inc.

Main Street Po Box 111 Lewistown IL 61542 309-547-3041. Tuesday March 1 2022. 051122 Subtax may be paid by prior year tax buyers if going to deed.

Tax amount varies by county. The Treasurers Office accepts Online Payments for the Following ONLY. Tax Year 2021 First Installment Due Date.

Contact the Treasurers Office for exact dates. 45 penalty interest added per State Statute. Suite 155 Wauseon Ohio 43567 Ph.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. By now all Fulton County property owners should have received tax statements by mail. The equalization factor currently being assigned is for 2021 taxes payable in 2022.

Last day to pay to avoid 10. Payments can be made through major credit cards eBilling eChecks Apple Pay and Google Pay. THE LAST DAY TO PAY LEVY YEAR 2020 REAL ESTATE TAXES BY CREDIT OR DEBIT CARD IS THURSDAY SEPTEMBER 29 2022.

Your list must be in permanent number order. If you have any further questions please call us at 217 384-3743 or email us at treasurercochampaignilus. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

Fulton County 65 Exemption with No Income Limit. 847-377-2000 Contact Us Parking and. In most counties property taxes are paid in two installments usually June 1 and September 1.

Created with Raphaël 212. See Results in Minutes. The 1st half 2021 Real Estate taxes are due by February 7 th 2022.

Different exemptions will apply to city school and county taxes. Taxes are due 272022. Fulton County Treasurer IL 100 N.

In a news release the county announced its board of assessors has mailed the 2021 assessment notices to all Fulton property owners and the deadline to appeal is Aug. 1st installment due date. Median Property Taxes No.

060122 1st installment due date. Taxes paid within 10 days of the due date are subject to 5 penalty. Delaware Quarterly Estimated Franchise Tax Pay 20 of estimated annual amount if annual amount expected to exceed 5000.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and. Tax sales in Fulton County Illinois. The median property tax in Fulton County Illinois is 1406 per year for a home worth the median value of 79000.

County boards may adopt an accelerated billing method by resolution or ordinance. City of Gloversville City Tax beginning December 1. 053022 MEMORIAL DAY - OFFICE CLOSED.

This exemption increases the basic homestead exemption from 30000 to 50000 for the Fulton County portion of property taxes. 15 penalty interest added per State Statute. Tax Year 2020 Second Installment Due Date.

Median Property Taxes Mortgage 1948. Elsewhere a county board may set a due date as late as June 1 The second installment is prepared and mailed by June 30 and is for the balance of taxes due. If you turned age 65 as of January 1 2021 you can now apply for this exemption.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Fulton County collects on average 178 of a propertys assessed fair market value as property tax. Illinois has one of the highest average property tax rates in the.

060222 Per Illinois State Statute 1½ interest per month due on late payments. Lake County IL 18 N County Street Waukegan IL 60085 Phone. Find Records For Any City In Any State By Visiting Our Official Website Today.

Hickman Kentucky Ky 42050 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Table Grove Illinois Il 61482 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Table Grove Illinois Il 61482 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Table Grove Illinois Il 61482 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

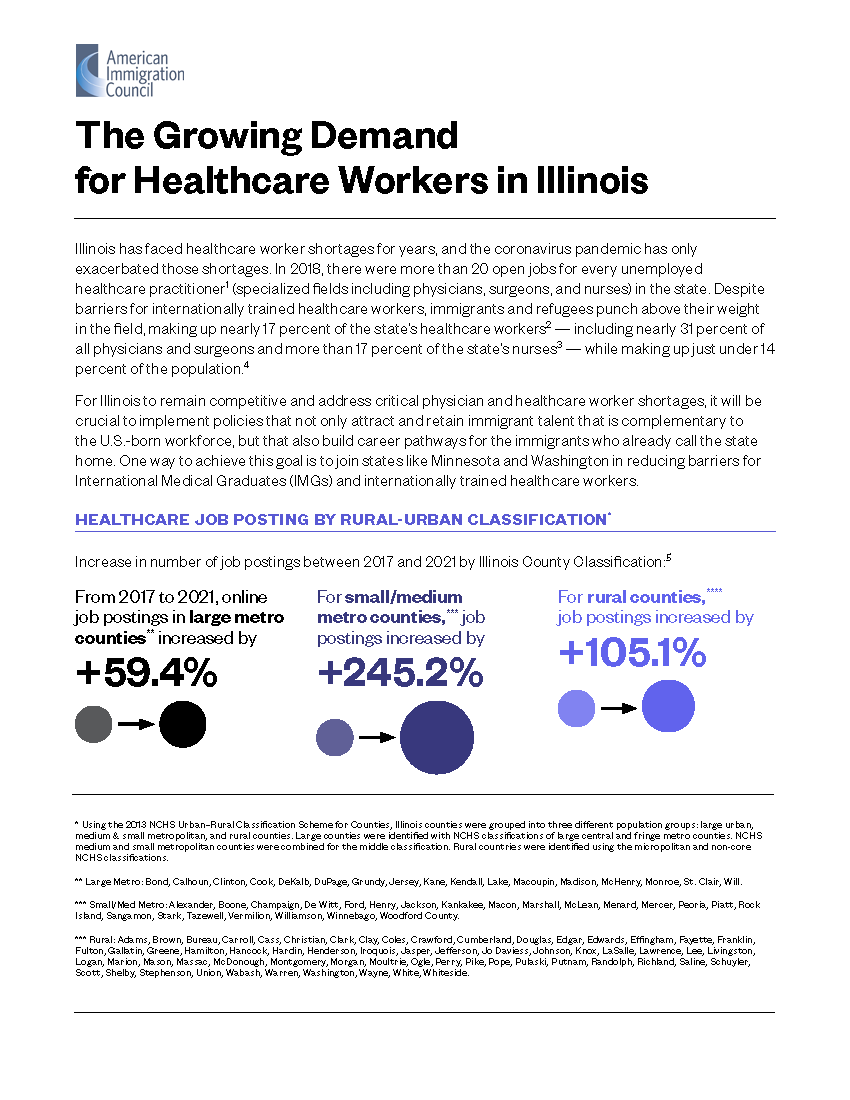

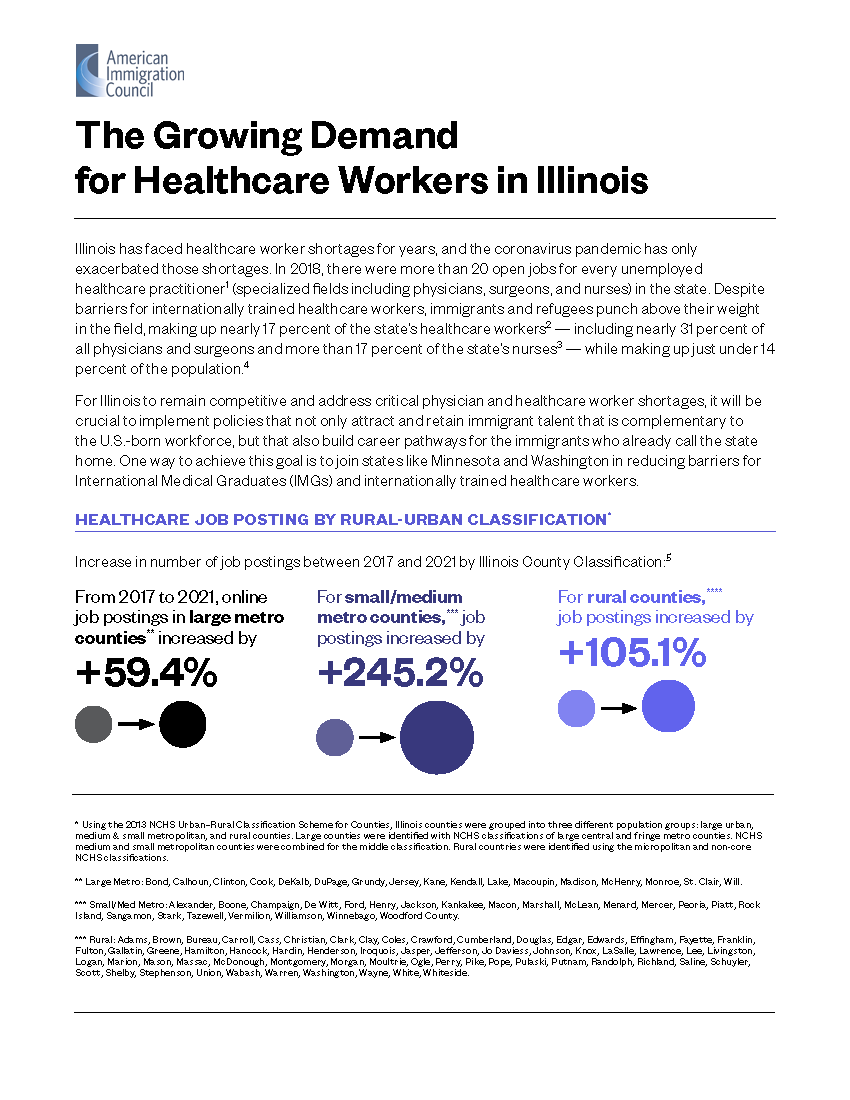

Fact Sheet American Immigration Council

Concerns Over Co News Illinois Times

Covid Transmission Risk High In Peoria Tazewell And Fulton Counties According To Cdc

Young Thug Gunna Arrested On Rico Gang Charges Chicago Sun Times

Tax Relief Available For Arkansas Illinois Kentucky And Tennessee Tornado Victims Kiplinger

Catherine Farmer High Resolution Stock Photography And Images Alamy